If your Medical Practice is not across the temporary payroll tax exemption available for Contractor GP's we encourage you to contact us so that we can determine how they impact your practice.

Breaking up is hard to do. Beyond the emotional and financial turmoil divorce creates, there are a number of business and tax related issues that need to be resolved.

ATO data analysis has revealed that over 16,500 self managed superannuation funds (SMSFs) have reported assets as having the same value for three consecutive years. With many of these assets residential or commercial Australian property, you can forgive the ATO for being incredulous.

The Treasurer is promising that inflation will decline by 0.75% as a direct result of the 2024-25 Federal Budget initiatives including energy relief for all households, a boost to Commonwealth Rent Assistance, and the freezing of the maximum co-payment on the Pharmaceutical Benefits Scheme.

The Government has announced that from 1 July 2025, the 15% concessional tax rate applied to future earnings for total superannuation balances (TSB) above $3 million will increase from 15% to 30%.

The redesigned Stage 3 personal income tax cuts explained, but beware, the impact will be less favourable than it would have been prior to the redesign.

Legislation enabling the small business energy incentive hit Parliament last week. The incentive is another broadly defined incentive to nudge behaviour, this time towards energy efficiency and “electrification.”

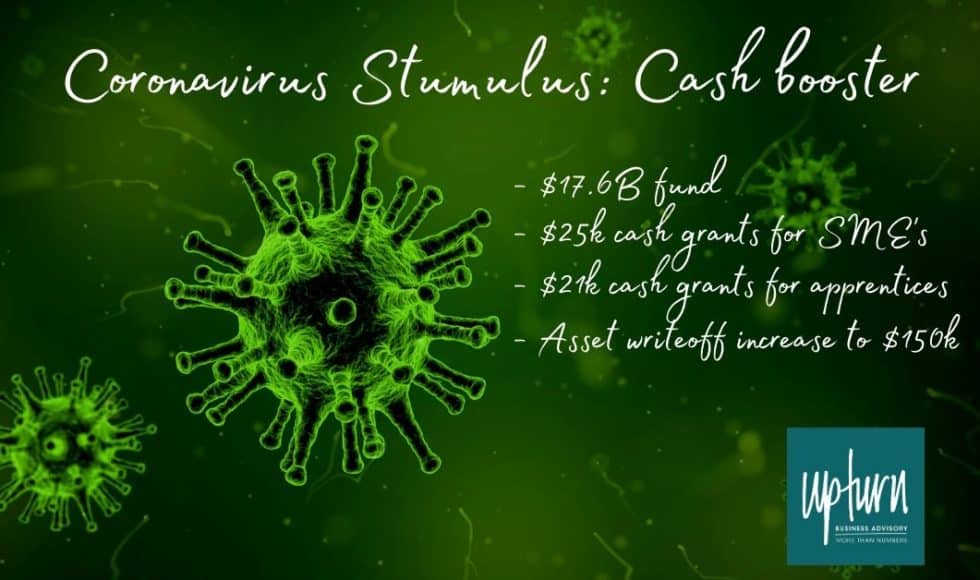

The Australian Government today announced a $17.6 billion stimulus package to support businesses, households and the Australian economy navigate the significant challenges brought on by the spread of the coronavirus. This article considers how SME's can benefit from the stimulus package.