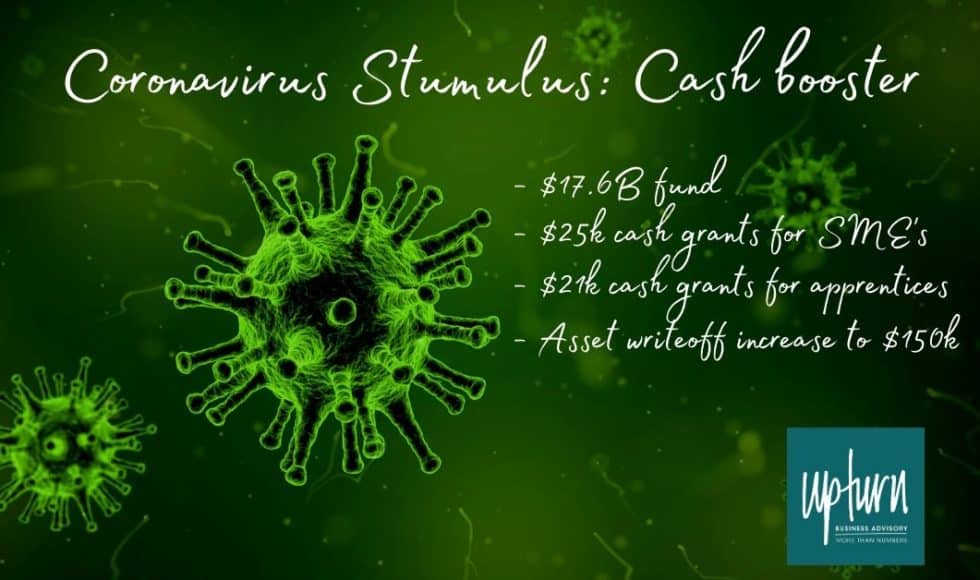

The Australian Government today (12/3/2020) announced a $17.6 billion stimulus package to support businesses, households and the Australian economy navigate the significant challenges brought on by the spread of the coronavirus.

Its purpose is to instil confidence in businesses to keep staff employed and the stimulus package will commence immediately and most likely end in June 2020. However, its likely that the package could be updated, broadened and/or extneded in the Federal Budget (May 2020) depending on whether the Coronavirus (and its effects on the economy) has been contained.

It is important that businesses are aware of the support provided so that they can:

- better understand what’s required to be eligible;

- be opportunitistic and bring forward employment opportunities (to further boost the economy and your business)

- take advantage of some of the “unlikely ever to be seen again” incentives

- help stimulate the economy and boost their business.

Cash flow assistance for SME’s up to $25k

Businesses with a turnover of less than $50 million that employ staff, between 1 January 2020 and 30 June 2020 will be entitled to a cash flow boost from the Federal Government of up to $25k to help with covering the cost of its workers.

The payment will be made to eligible businesses by the ATO, upon lodgement of the January to March and April to June 2020 BAS’s/IAS’s. The calculation of the cash grant will be based on the amount of PAYG withheld and reported in the BAS’s/IAS’s.

Whilst the legislation supporting the above is yet to be drafted, it is not yet clear whether the cash grant will be based on 50% of the PAYG withheld or 50% of employees’ salaries (capped at $25,000) that have been reported in the BAS’s/IAS’s (**watch this space**).

Regardless, the ATO have promised that the funds will be paid within 14 days of lodgement of the BAS/IAS. This means that the first payment should be expected end of April/start of May 2020.

Stimulus packages like this do not come around often, therefore, we encourage businesses to get in touch with their advisor to put in place measures to take advantage (where possible)

Instant asset write off now $150k until 30/6/20

The Government is lifting the instant asset writeoff threshold to $150,000 (from $30,000) and making more businesses eligible to use it (turnover increased from $50M to $500M). This significant increase is only temporary, starting today and ending 30 June 2020.

The purpose of this measure is to keep businesses spending by offering incentives to buy things such as vehicles and equipment. By bringing forward planned spending, the government is aiming to stave off recession and hopefully boost consumption to ensure workers employed.

50% depreciation accelleration until 30/6/21

The Government is acceleratng depreciation deductions starting today until 30 June 2021 by allowing businesses to deduct an additional 50% of an asset cost in its year of purchase.

Apprentices & Trainees

A $1.2bn war chest has been made available to subsidise 50% of an apprentice’s or trainee’s wage for up to nine months from 1 January 2020 to 30 September 2020 (capped at $21,000 per apprentice/trainee).

Stimulus packages like what we have seen from the Government today do not come around often, therefore, we encourage businesses to:

- Contact your proactive Upturn Business Advisor to assess your eligibility;

- Reassess (or adjust) your budget and forecasts to ensure there is room for additional investment to take advantage of the stimulus package;

- Implement the agreed plan to benefit your business, the economy and Australia as a whole!

If you havent already booked your annual tax planning meeting with your Upturn Business Advisor, in light of the above stimulus package we recommend you book it no later than 23 March 2020 to ensure you are in a position to take advantage of all what it has to offer. More information can be found on the Economic Stimulus Package announcement.

This information is only general in nature; it does not take into account your personal or business situation or objectives; it is not intended to replace professional advice and should not be acted upon. For professional advice based on your individual circumstances, please do not hesitate to contact us.