Insights

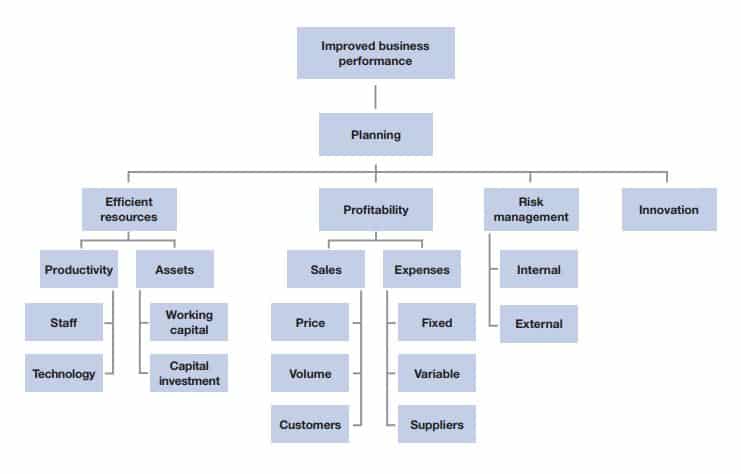

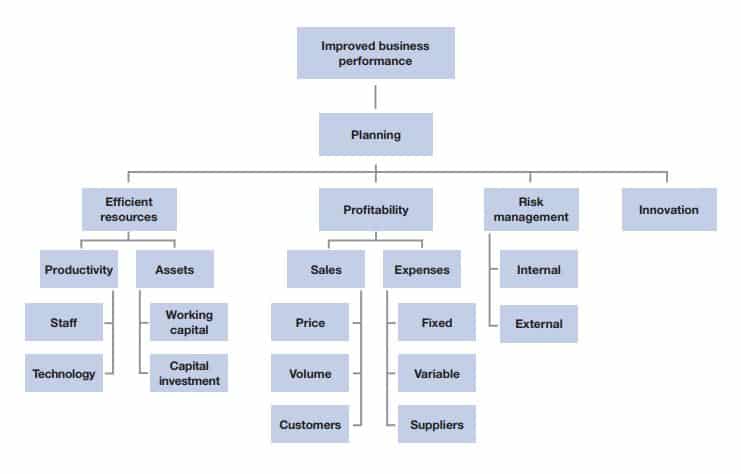

We work with small businesses to get a good understanding of the key drivers in their businesses (shown in the diagram below), work relentlessly to improve them and finally we evaluate the performance against KPI’s and targets.

For your small business to be successful, we need to ensure that the business is operating as efficiently and effectively as possible, and this is where our experience counts

We’ll then work with you to ensure continual improvement in each of the below key drivers to ensure that your resources are being utilised most efficiently and effectively at all times.

We harness insights to add efficiency

To improve your businesses performance, we need to improve productivity. We’re not only referring to staff and asset (working capital, stock, work in progress) productivity, we’re also referring to leveraging the use of cost-effective technology in your business.

Technology has been a game changer for many of our clients. It has saved considerable time, lowered costs, improved efficiency, increased revenue and has provided a better understanding of customers and their buying needs.

Data analytics to identify opportunities

We are data analytics experts and this is crucial in being able to harness the data in your business to its full potential. We’ll use this information to generate ideas to stimulate growth and revenue whilst presenting cost saving initiatives.

Real-time reporting for effective decision making

As a business owner, analysing your financial performance in a timely manner is critical to be able to capitalise on an opportunity or make a change to stop further ‘bleeding’.

We know that analysing historical financial reports spat out by accounting systems can be difficult (and boring) for accounting professionals, let alone small business owners. Ill-informed decision making based on old data can lead to a potentially disaster.

That’s why our team have worked tirelessly to develop a simple, graphical and well presented reporting structure to allow you to gain insights into the key drivers in your business in real-time.

Budgeting & cash flow forecasting

Lets face it, 90% of small businesses fail due to cash flow issues, not due to product or service issues. To avoid being part of this sad statistic we need to be proactive by thinking ahead and making changes before its too late.

A budget and cash flow projection allows us to identify and steer clear of many crisis situations by addressing them before they have a negative impact on the business.

Performance reporting

Our performance reporting includes

- Management reporting

- Trend analysis & reporting

- Sales comparison reporing

- Financial analysis & KPI’s

- Cash flow management

- Forecasting & Budgeting

- Compliance Management

- Regulatory reporting

- Accounting & Administration

- Financial & non-financial measurement