We expected the Federal Budget 2020-21 to stimulate small businesses and the economy, to help small business recover from the impact of the coronavirus pandemic and boost business confidence.

Here is an overview of the Federal Budget 2020-21 announcements and what they mean for small businesses.

The biggest items in the budget for small business are expanding the instant asset write off, introducing loss carry back, expanding R&D tax incentives, JobMaker hiring credits & bringing forward personal income tax cuts.

Tax Concession for Victorian COVID-19 Business Grants

The Victorian Government’s COVID-19 business support grants will now become tax free to SME's. This tax free status will be extended to other States & Territories as well. Considering Victorian businesses have been eligible for up to $30k in grants, this is a tax saving of approximately $8k.

Limitless Instant asset write-off for SME's up to 30 June 2022

The Government has removed the $150,000 cap which was announced earlier this year as part of its COVID-19 stimulus package. Applies from 7 October 2020 to new or second hand depreciable assets ($59,136 cap remains for passenger vehicles).

Loss carry back: reclaim tax paid on last years profits

The budget introduced a loss carry-back scheme that will allow companies to claim back taxes paid on last year’s profits if they are now in a loss. This means SME's can claw back some of the taxes they paid, helping even things out a little.

R&D Tax Incentives $2B boost

The Federal Budget 2020-21 has rolled back most of the R&D cuts previosuly announced and added some $200 million to the value of the R&D Tax Incentive in a massive boost to the Tech & Startup sectors.

$7M to provide free, one-on-one mental health support to SME's

The program will provide small business operators with six free, one-on-one telehealth sessions with trained mental health professionals who have experience in the small business space, and is expected to be available early next year.

$4B JobMaker: $200/wk credit to SME's to hire workers aged 16-35

$200-per-week incentive to hire workers aged between 16 and 35. This is available for young workers who have received JobSeeker, Youth Allowance or a Parenting Payment for one of the three months before being hired.

50% wage subsidy for Apprentices & Trainees (100,000 places)

Businesses that hire a new Australian apprentice or trainee on or after 5 October 2020 will qualify for a 50% wage subsidy (capped at $7,000 a quarter) until 30 Sept 2021. Applies to all industries and locations, until a cap of 100,000 is reached.

Boosting Female Founders Initiative to support up to 282 additional start-ups

A further $35.9 million will be invested in the Boosting Female Founders Initiative to support up to 282 additional start-ups and 4,300 women entrepreneurs. This initiative will also create a new service to provide access to expert mentoring and advice for women entrepreneurs.

Insolvency reforms to allow businesses to trade out of the economic crisis

Extended temporary bankruptcy protections (until 31 December 2020) that save small business owners from personal liability for trading while insolvent during the COVID-19 pandemic. Also simplifying the liquidation process for SME's to allow faster and lower cost of liquidation.

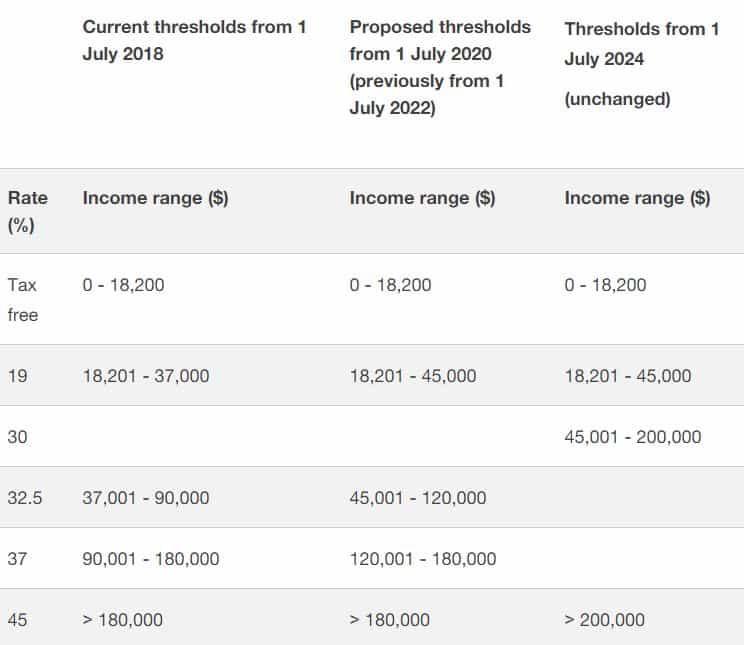

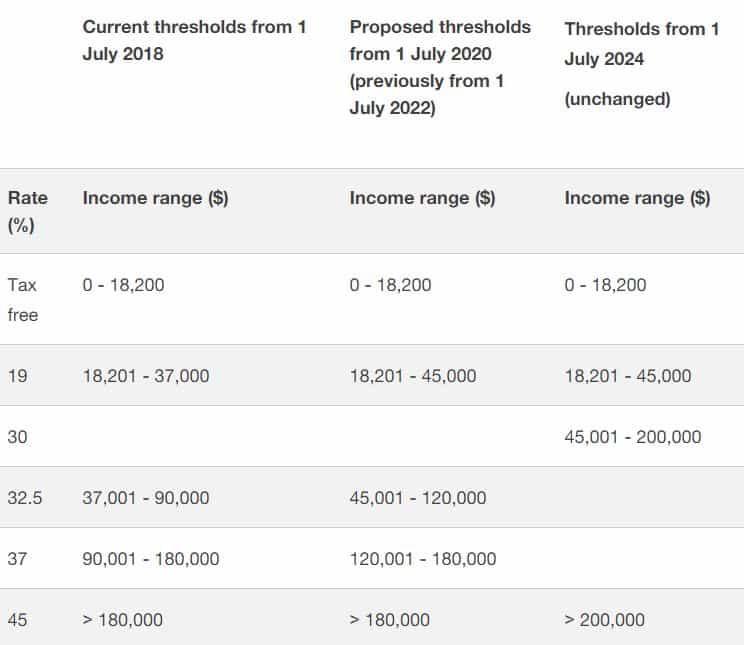

Bringing forward personal income tax cuts by 2 years

Tax cuts scheduled to start in July 2022, are being brought forward and backdated to July 2020. This will deliver an immediate boost to household budgets and expected to result in future spending increases on goods and services across all businesses, including SMEs.

Workers who earn more than $90,000 will take home up to $2,565 extra, while people earning more than $120,000 receiving the maximum benefit.

Workers who earn more than $90,000 will take home up to $2,565 extra, while people earning more than $120,000 receiving the maximum benefit.